Ryan Anderson

& Kylee Mollotte

Annuity 101

LIVE CLASS

Expert annuity instructors, Kylee Mollotte and Ryan Anderson teach the fundamentals to annuities, understanding annuity language, and preparing for appointments.

Course Information

Objective: Train life, Medicare, and LTC producing agents how to successfully add annuity production to current business.

No-cost, 6-week long program

Training sessions are 2 hours on a weekly basis held over zoom. This is a live meeting with 6-10 agents/class.

Some of the items we'll cover:

What are annuities and how do they work?

How do I calculate liquidity and make sure I am compliant?

How do I read and explain illustrations to clients?

Which product do I use for Income, increasing income, LTC, growth or for enhanced death benefits?

What are caps, spreads, par rates and how do they affect the indexes I select?

What is the most effective way to educate a client on annuities to insure a high close rate?

How can I modify my current sales process to insure I get as many opportunities as possible.

Expectations

Attendance is required for this class. Missing classes will result in your removal from the course.

We expect the following of class participants:

Attend all 6 sessions

No driving, multitasking

Active involvement

Audio and camera on

Complete class assignments (2-3 hours of weekly homework)

Class Materials

3 Recommended Resources

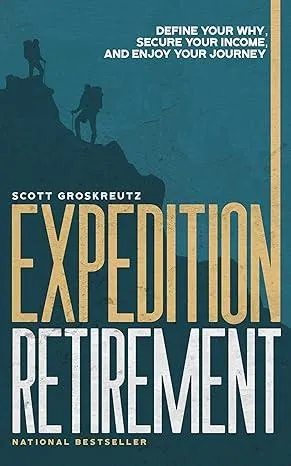

Expedition Retirement

Define Your Why, Secure Your...

Description

YOU’VE REACHED THE PEAK. READY FOR THE DESCENT?

You've been climbing the career mountain for decades. But are you prepared for what comes after you reach the summit? If retirement feels like a daunting cliff, you need a guidebook to navigate this new terrain.

Here's a retirement truth most overlook: reaching the pinnacle is just the start. Just like climbing Mount Everest, it's not only about reaching the top—it's about the journey down, too. In this book you’ll discover some vital principles for a fulfilling descent, such as:

Defining Your Retirement

Why

The Three Income Buckets

The Retirement Uncheck List

Whether you’re on secure financial footing or you feel like you’re teetering on the edge, it’s never too late to get clarity and take control. Expedition Retirement is a compass as you embark on your greatest adventure yet. It's time to define your why, secure your income, and—most importantly—enjoy every step of the way.

Income Allocation

Enhance Your Retirement Security

Description

When you stop working and the paychecks no longer arrive regularly, how will you replace them? In Income Allocation: Enhance Your Retirement Security, you'll discover how to keep the cash flowing in retirement like you did during your working years. Financial advisor David Gaylor reveals how you can assure yourself of regular, reliable income, regardless of how financial markets perform or how long your retirement lasts.

Paychecks and Playchecks

Retirement Solutions for Life

Description

Paychecks and Playchecks: Retirement Solutions For Life is a guide for retirement that is built for uncertain markets like the one we are in today. The Paychecks and Playchecks strategy is a mathematically and scientifically proven approach that will enable you to create a secure retirement, no matter how long you live. You will learn how to retire with enough guaranteed lifetime income to cover your basic expenses and how to optimize the rest of your portfolio to make sure you receive your playchecks. You want to feel comfortable that you have a strategy in place so that your basic living expenses are covered for life―and there is something leftover to play with. With the crazy financial markets of the last decade, most people feel that a storybook retirement is no longer possible. Here to save the day is Tom Hegna, an economist, retired Lieutenant Colonel and former senior executive officer of a Fortune 100 company. He shares the math and science behind a successful retirement. Despite what most experts say, happily ever after is still within your grasp.

Register for Class

Courses

Listen

Social

About

Secured with SSL

2024 Annuity Fundamentals. All Rights Reserved.

This website is designed for financial professional use only. It should not be considered an advertisement for the provision of investment advisory services or for the sale of insurance products to retail investors.